Types of Cryptocurrencies: Beyond Just Bitcoin

Think of cryptocurrencies like vehicles. You have cars, trucks, buses, and bikes. They all get you from one place to another, but they are very different in how they work and what they’re best for. Cryptocurrencies are similar!

Here are the main types you’ll hear about:

- Coins (like Bitcoin – BTC, Ethereum – ETH)

- What are they? These are the original type of cryptocurrency. A “coin” is a digital currency that has its own independent blockchain. They are usually designed to be a digital form of money, a medium of exchange, or a store of value (like digital gold).

- How they work: They are the fundamental currency of their own network. You use them to pay for transaction fees on their specific blockchain.

- Examples:

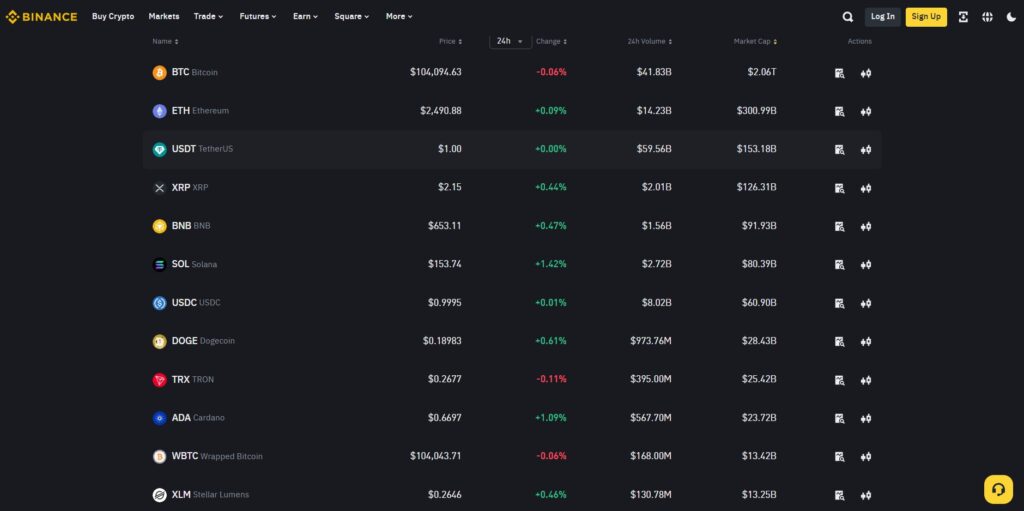

- Bitcoin (BTC): The first and most famous. It operates on the Bitcoin blockchain and is primarily seen as “digital gold” or a way to transfer value.

- Ethereum (ETH): This is where it gets interesting. ETH is the native coin of the Ethereum blockchain. While it’s used for payments (like Bitcoin), its main purpose is to “fuel” the Ethereum network. Think of it as the ‘petrol’ you need to run applications and make transactions on the Ethereum blockchain. Ethereum is much more than just a currency; it’s a platform for building other digital things.

- XRP, Litecoin (LTC), Solana (SOL), Cardano (ADA), TRX (TRON): These are other examples of coins that each have their own blockchain.

2. Tokens

- What are they? Unlike coins, tokens do NOT have their own independent blockchain. Instead, they are built on top of an existing blockchain, like Ethereum, Binance Smart Chain, or Polygon.

- How they work: Tokens are created to serve a specific purpose within a particular project or application that runs on an existing blockchain. They can represent assets, services, voting rights, or other unique functionalities.

- Think of it like this: If a blockchain (like Ethereum) is a smartphone, then tokens are like the apps that run on that smartphone. You need the phone (the coin/blockchain) to use the apps (the tokens).

- Examples:

- Utility Tokens: Give you access to a specific product or service within a blockchain project. For example, if there’s a new blockchain game, its token might be used to buy items in the game.

- Governance Tokens: Allow holders to vote on important decisions about the future direction of a blockchain project (like a decentralized company).

- Security Tokens: These are like digital shares of a company or real-world assets (like real estate) that are put on the blockchain. They often represent ownership.

- Thousands of Tokens: There are countless tokens. Many are built on the Ethereum blockchain following a standard called ERC-20 (e.g., Uniswap – UNI, Chainlink – LINK).

Key Difference between Coins and Tokens:

- Coins: Have their own blockchain.

- Tokens: Are built on top of an existing blockchain.

3. Stablecoins

- What are they? These are a special type of cryptocurrency designed to maintain a stable value. They do this by “pegging” (linking) their value to something outside the crypto world that is generally stable.

- How they work: Most commonly, they are pegged 1:1 to a traditional currency like the US Dollar. So, 1 Stablecoin (USD-pegged) should always be worth roughly 1 US Dollar. Some are also pegged to commodities like gold.

- Why are they needed? Regular cryptocurrencies like Bitcoin can go up and down wildly in value. Stablecoins help people in the crypto world avoid this volatility. They are useful for:

- Trading: Crypto traders often move their funds into stablecoins during times of high market uncertainty to protect their money from price drops, without having to convert back to Indian Rupees or US Dollars through a bank.

- Payments: Since their value is stable, they are more practical for making everyday payments or sending money without worrying about the value changing drastically.

- Examples:

- Tether (USDT): The most popular stablecoin, usually pegged to the US Dollar.

- USD Coin (USDC): Another very popular stablecoin, also pegged to the US Dollar.

- Dai (DAI): An example of an algorithmic stablecoin that uses smart contracts and other cryptocurrencies to maintain its peg.

4. Memecoins

- What are they? These are cryptocurrencies that start as a joke or are inspired by internet memes, pop culture, or social media trends. They often lack any serious technical purpose or practical use.

- How they work: Their value is primarily driven by social media hype, community enthusiasm, celebrity endorsements (like Elon Musk often tweeting about Dogecoin), and speculation rather than underlying technology or real-world utility.

- Risk: They are considered extremely volatile and high-risk investments because their value can skyrocket purely based on hype and then crash just as quickly when the hype fades. They often have very large supplies, making each coin very cheap, which attracts many small investors hoping for quick gains.

- Examples:

- Dogecoin (DOGE): The original and most famous memecoin, started in 2013 as a joke based on the Doge meme.

- Shiba Inu (SHIB): Known as the “Dogecoin killer,” it also uses the Shiba Inu dog as its mascot and gained massive popularity.

- Pepe (PEPE), Bonk (BONK): Newer examples that gained popularity based on specific internet memes.

Understanding these different types will help you navigate the diverse and often confusing world of cryptocurrencies! Remember, each type carries its own level of risk and serves different purposes.