In the often overwhelming world of personal finance, it’s easy to feel pulled in a dozen directions. From saving for retirement and a down payment to paying off debt and managing daily expenses, the sheer volume of financial tasks can lead to analysis paralysis or, worse, neglecting truly important goals. This is where the Eisenhower Matrix, a powerful decision-making tool, proves invaluable. Developed by former U.S. President Dwight D. Eisenhower, this matrix helps individuals prioritize tasks based on their urgency and importance, offering a clear roadmap for action, especially when it comes to your money.

What is the Eisenhower Matrix?

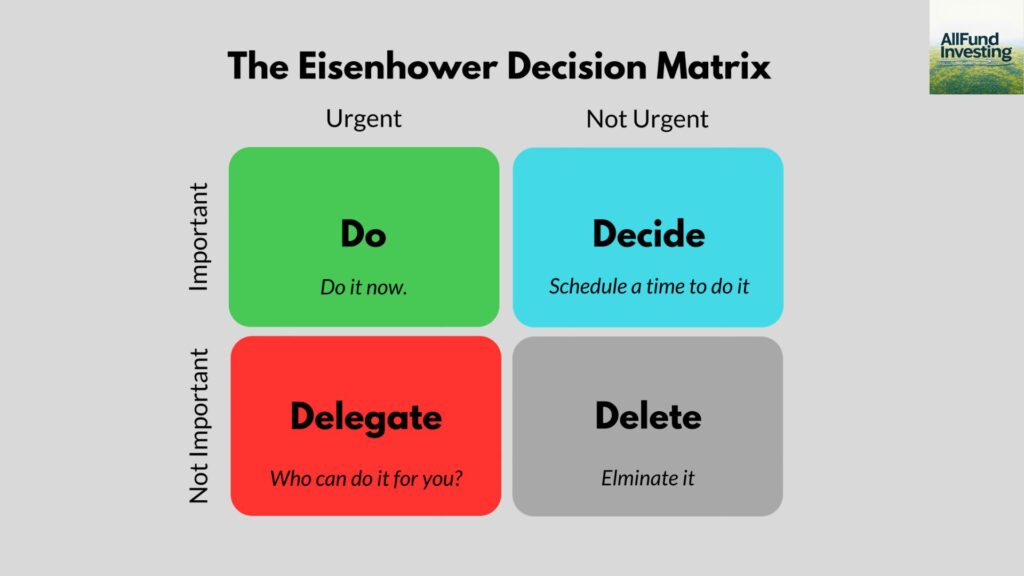

The Eisenhower Matrix, also known as the Urgent-Important Matrix, is a simple 2×2 grid that categorizes tasks into four quadrants:

- Quadrant 1: Urgent & Important (Do First) These are tasks that demand immediate attention and have significant consequences if not addressed promptly. They are often “crises” or pressing deadlines.

- Quadrant 2: Important, But Not Urgent (Schedule) These tasks are crucial for your long-term goals and well-being but don’t have an immediate deadline. This quadrant is often considered the most vital for long-term success, as it focuses on proactive planning and prevention.

- Quadrant 3: Urgent, But Not Important (Delegate) These tasks seem pressing but don’t contribute significantly to your own long-term objectives. They often involve interruptions or requests from others. The ideal approach here is to delegate them if possible, or minimize the time spent on them.

- Quadrant 4: Not Urgent & Not Important (Eliminate) These are distractions and time-wasters that offer little to no value. Tasks in this quadrant should be eliminated or drastically reduced.

How it Helps in Identifying Priorities for Personal Finance

The Eisenhower Matrix helps prioritize personal finance goals by categorizing tasks into four quadrants based on urgency and importance, enabling efficient focus and resource allocation. Here’s how it works with a brief example:

- Urgent and Important (Do First): Critical financial tasks needing immediate action, like paying overdue bills to avoid penalties.

- Important but Not Urgent (Schedule): Long-term financial goals, like saving for retirement or investing, planned for consistent progress.

- Urgent but Not Important (Delegate): Time-sensitive but less critical tasks, like routine bill payments, which can be automated.

- Not Urgent and Not Important (Eliminate): Non-essential spending or activities, like impulse purchases, that derail financial goals.

Example:

- Do First: Pay credit card bill due tomorrow to avoid late fees.

- Schedule: Set up monthly contributions to an emergency fund.

- Delegate: Automate utility bill payments.

- Eliminate: Cancel unused subscriptions to save money.

This approach ensures focus on high-impact financial tasks, reduces stress, and aligns actions with long-term goals.

Conclusion

The Eisenhower Matrix is more than just a time management tool; it’s a strategic framework for intentional living, especially when applied to personal finance. By consistently categorizing your financial tasks based on urgency and importance, you can move beyond simply reacting to financial demands and instead proactively build the financial future you envision. It helps you schedule your priorities rather than prioritizing what’s on your schedule, ensuring that your most important financial goals receive the attention they deserve, leading to greater financial security and peace of mind.