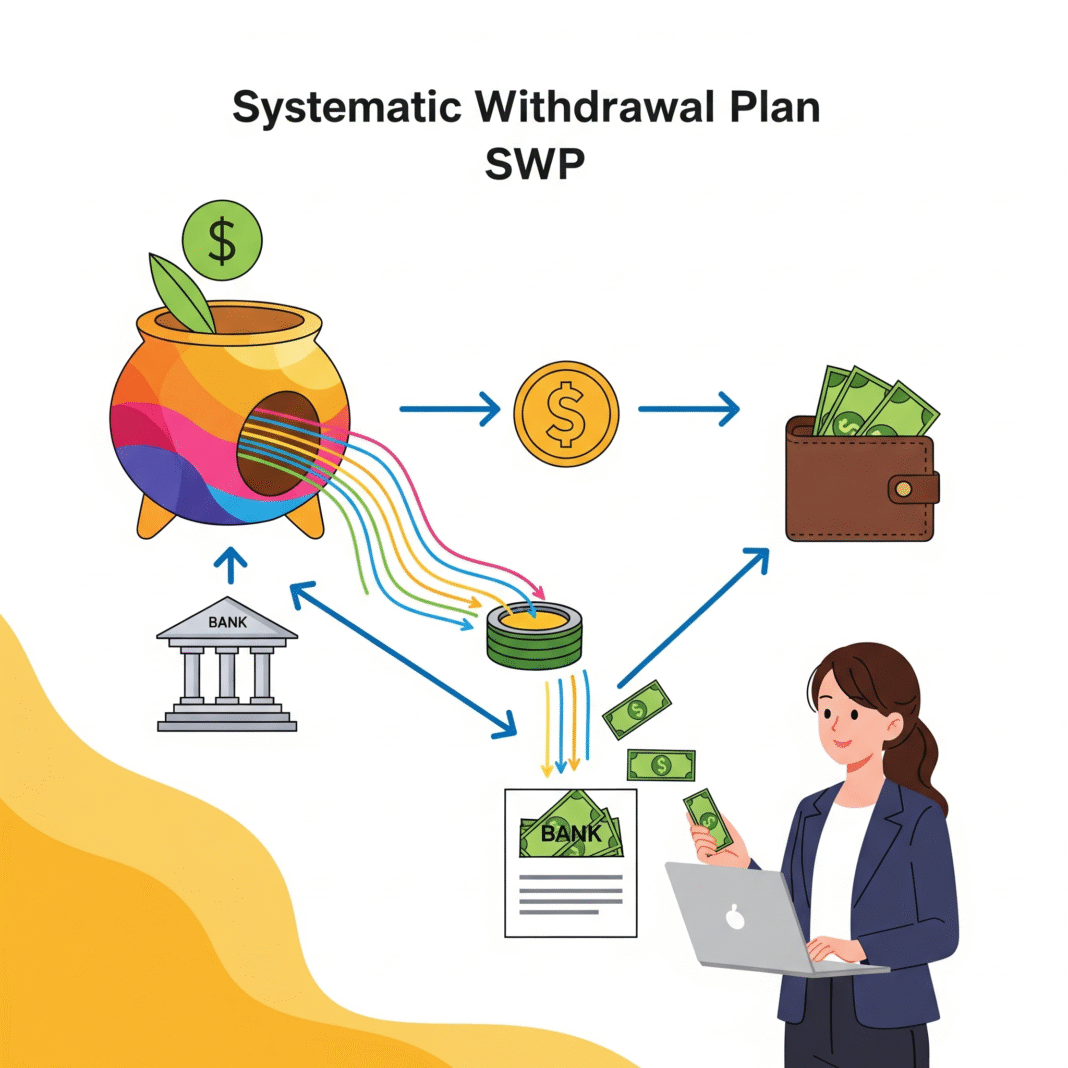

SWP stands for Systematic Withdrawal Plan. It’s a facility offered by mutual funds that allows investors to withdraw a predetermined amount of money from their mutual fund investments at regular intervals. Think of it as the reverse of a SIP (Systematic Investment Plan).

Here’s a breakdown:

- Purpose: SWPs are primarily designed for investors who need a regular income stream from their investments. This is particularly popular among retirees, individuals taking a sabbatical, or anyone who has accumulated a lump sum and wants to draw a consistent income while allowing the remaining capital to potentially continue growing.How it Works:

- Lump Sum Investment: You typically start by investing a lump sum amount in a mutual fund scheme.

- Set Up SWP: You then instruct the mutual fund house or your financial advisor to set up an SWP. You specify:

- The amount you want to withdraw (e.g., ₹10,000 per month).

- The frequency of withdrawal (e.g., monthly, quarterly, semi-annually, annually).

- The date of withdrawal (e.g., 5th of every month).

- Unit Redemption: On the chosen withdrawal date, the mutual fund automatically redeems (sells) a sufficient number of your mutual fund units at the prevailing Net Asset Value (NAV) to generate the specified withdrawal amount.

- Credit to Bank Account: The withdrawn amount is then credited directly to your registered bank account.

- Remaining Investment: The remaining units in your mutual fund scheme continue to be invested and grow (or fall) based on market performance.

- Key Features & Benefits:

- Regular Income: Provides a predictable and steady cash flow.

- Capital Appreciation Potential: Since only a portion of your investment is withdrawn, the rest remains invested, potentially continuing to grow over time.

- Flexibility: You can usually choose the withdrawal amount and frequency and even stop or modify the SWP at any time.

- Tax Efficiency: In India, only the capital gains portion of your withdrawal is taxed, not the entire withdrawal amount. This can be more tax-efficient compared to other income sources like fixed deposit interest. There’s also no TDS (Tax Deducted at Source) for resident individual investors on SWP withdrawals from mutual funds.

- Disciplined Withdrawals: Helps avoid impulsive large withdrawals and provides a structured way to manage your finances.

In essence, SWP offers a smart way to create a regular income stream from your mutual fund investments, balancing your need for liquidity with the potential for long-term growth of your remaining capital.