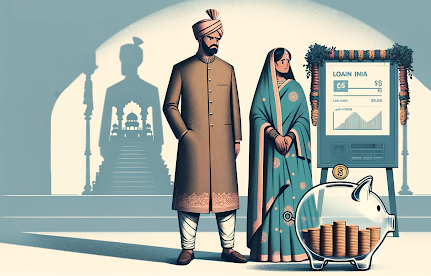

In India, weddings are emotional events — deeply rooted in culture, tradition, and family pride. but funding them with personal loans or credit cards is one of the most common and dangerous financial mistakes people make. It feels convenient, but you end up paying for those few days of happiness for years to come.

The Glitter of Now, the Burden of Later

Even if you borrow from relatives or friends (which many do), you’re still creating a financial burden that affects your future goals — like buying a home, building a business, or investing in your child’s education.

🚫 What’s the Problem?

1. No Returns, Only Pressure

A grand wedding or international trip might feel necessary, but they generate zero financial returns. You spend lakhs, and once it’s over, it’s just a memory — not an asset.

2. Informal Loans Create Silent Pressure

Even if you borrow from your uncle, aunt, or neighbor:

- It affects relationships.

- You may feel guilty or obligated.

- Repayment delays can lead to social discomfort.

What You Can Do Instead – Realistic, Indian-Style Planning

🔹 1. Start Saving Early – Even Small Amounts Count

If your child is 10 years old today, and you save ₹1,000/month in a mutual fund or Sukanya Samriddhi Yojana, you’ll have over ₹3–4 lakh by the time they turn 20 — without touching debt. You can have in multiple accordingly your investment.

🔹 2. Use Government Schemes Wisely

- Sukanya Samriddhi Yojana: For daughters below 10 years.

- Balika Samriddhi Yojana: Supports education and small savings for girls.

- Post Office Recurring Deposit: Safe and disciplined.

- PPF (Public Provident Fund): Long-term savings with tax benefits.

🔹 3. Ask for Help — Without Loans

In many Indian families, weddings are collective efforts. Instead of loans:

- Discuss a modest budget with family.

- Accept direct contributions (like gold, sarees, catering support).

- Cut down on unnecessary show-off expenses like drone shoots or designer décor.

🔹 4. Create a Simple, Joyful Event Within Budget

No one remembers how fancy the plates were — but they remember if the food was warm and the mood was happy. Stick to your budget. Spend where it matters emotionally, not where it drains financially.

Final Word: Stay Grounded, Stay Free

Borrowing, even informally, ties you down. Living debt-free gives you the confidence to grow.

So when planning your wedding or dream trip, remember:

Big celebrations don’t need big loans — just big hearts and smart planning.