CAGR, or Compound Annual Growth Rate, or Annualized Returns is a financial metric that represents the average annual growth rate of an investment over a specified period, assuming the profits are reinvested (compounded). It “smoothest out” the year-to-year volatility to give you a single, consistent growth rate.

What is CAGR?

Imagine your investment didn’t grow erratically each year (e.g., 10% one year, -5% the next, then 15%). CAGR calculates the hypothetical constant rate at which your investment would have needed to grow each year to reach its final value from its initial value, assuming all earnings were reinvested.

Okay, let’s make CAGR super simple!

Imagine you bought a magic plant on January 1, 2020, for ₹1,000.

You want to see how much it grew each year on average.

Here’s how much your plant was worth on New Year’s Day each year:

- January 1, 2020 (Start): ₹1,000 (This is your Beginning Value)

- January 1, 2021: ₹1,100 (It grew 10% this year)

- January 1, 2022: ₹1,200 (It grew 9% this year)

- January 1, 2023: ₹1,400 (It grew 16.7% this year)

- January 1, 2024: ₹1,350 (Oops! It shrunk a bit this year, -3.6%)

- January 1, 2025 (End): ₹1,600 (This is your Ending Value)

You want to know the average consistent growth rate over these 5 years, even though it went up and down.

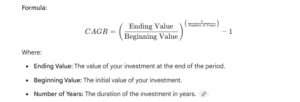

Here’s the CAGR calculation:

- Ending Value: ₹1,600

- Beginning Value: ₹1,000

- Number of Years: From Jan 1, 2020, to Jan 1, 2025, is exactly 5 years.

What does this mean?

Even though your magic plant’s growth was bumpy (10%, 9%, 16.7%, then -3.6%), its Compound Annual Growth Rate (CAGR) was 9.85%. This means, on average, if your plant had grown by a consistent 9.85% every single year, it would have still reached ₹1,600 from ₹1,000 in 5 years.

CAGR and Annualized Returns: A Close Relationship

You might hear terms like “annualized returns” or “annualized growth rate.” It’s important to know how this relates to CAGR:

For any single lump-sum investment that grows over a period longer than one year, CAGR is the annualized return. They are essentially the same thing in this context. CAGR specifically calculates that “average annual profit percentage” we talked about, assuming the returns are compounded each year.

The term “annualized return” is a broader concept. It means converting the total return of any investment period (whether it’s 6 months, 3 years, or 10 years) into an equivalent annual rate. So, while CAGR is the specific formula for annualizing returns over multiple years for a single investment, “annualized returns” is the general idea of putting all investment performance on a yearly comparable scale. This makes it easier to compare different investments, no matter how long they were held.

What is CAGR Used For?

CAGR is a powerful tool for:

- Measuring Investment Performance: It provides a clear, annualized return for a single lump-sum investment over a period longer than one year. This is particularly useful for stocks, mutual funds (for direct lump-sum investments), and other assets where you invest once and let it grow.

- Comparing Investments: Since it standardizes the growth rate to an annual figure, CAGR allows you to compare the historical performance of different investments (e.g., Stock A vs. Stock B, or Mutual Fund X vs. Mutual Fund Y) over the same time period, even if their actual year-to-year returns fluctuated wildly.

- Assessing Business Growth: Companies use CAGR to analyze the growth of various metrics like:

- Revenue growth: How quickly sales are increasing over several years.

- Profit growth: The average annual increase in profits.

- Market share growth: How a company’s share of the market is expanding.

- Financial Forecasting: By looking at past CAGRs, investors and businesses can make reasonable assumptions about future growth rates for planning and forecasting.

- Benchmarking: You can compare an investment’s CAGR against a relevant market index (like Nifty 50 or S&P 500) or industry average to see if it has outperformed or underperformed.

Key Difference from XIRR:

While both measure annualized returns, CAGR is best for single lump-sum investments where you’re looking at the growth from one point to another. XIRR is superior for situations with multiple, irregular cash flows (like SIPs or SWPs), as it accounts for the exact dates of each inflow and outflow, providing a more accurate “true” return in those complex scenarios.

here’s a direct link to a page that does feature a clear, easy-to-use CAGR calculator:

https://www.bajajamc.com/mutual-fund-calculators/cagr-calculator