Imagine this: You begin investing ₹5,000 every month — an amount that’s manageable for many salaried individuals. It may not seem like a big step. But over time, with the silent force of compounding at work, that steady investment has the power to grow into a substantial corpus.

Welcome to the world of SIPs (Systematic Investment Plans), where discipline and patience, not sudden windfalls, create true wealth.

What Is a SIP?

A SIP is a disciplined investment method where you invest a fixed amount regularly (usually monthly) into a mutual fund. It’s like a recurring deposit, but instead of a fixed interest rate, your money is invested in markets or equity — giving it potential to grow faster over time.

Unlike one-time investing, SIPs ride the ups and downs of the market. This means you’re not guessing the “right time” to enter. Over years, this smooths out volatility — a concept known as rupee cost averaging.

The Crorepati Math: Let the Numbers Talk

Let’s say you start a SIP of ₹5,000 per month in an equity mutual fund with a 12% annual return — which has been the average for many diversified equity mutual funds over the long term.

| Years Invested | Monthly SIP | Total Invested | Estimated Value @12% CAGR |

|---|---|---|---|

| 10 years | ₹5,000 | ₹6 lakh | ₹11.6 lakh |

| 20 years | ₹5,000 | ₹12 lakh | ₹49.9 lakh |

| 30 years | ₹5,000 | ₹18 lakh | ₹1.76 crore |

That’s right. Just ₹5,000 a month can grow into ₹1.76 crore if you stay invested for 30 years.

Why It Works: The Mathematical Magic of Compounding

Compounding is not just a financial buzzword — it’s a proven mathematical principle that helps money grow faster over time. It works by earning returns not just on your initial investment, but also on the returns previously earned. This creates a snowball effect, where wealth accelerates as time passes.

The formula for compound interest is: A=P×(1+r)nA = P \times (1 + r)^nA=P×(1+r)n

Where:

- A = Future value of the investment

- P = Principal (initial investment)

- r = Annual rate of return (in decimal)

- n = Number of years

Example:

Let’s say you invest ₹1 lakh at a 12% annual return.

- After 1 year: ₹1,00,000 × (1 + 0.12) = ₹1,12,000

- After 2 years: ₹1,12,000 × 1.12 = ₹1,25,440

- After 10 years: ₹1,00,000 × (1.12)^10 = ₹3,10,585

- After 20 years: ₹1,00,000 × (1.12)^20 = ₹9,64,629

Your money nearly triples in 10 years and multiplies almost 10x in 20 years — without adding anything extra — just by letting time do its work.

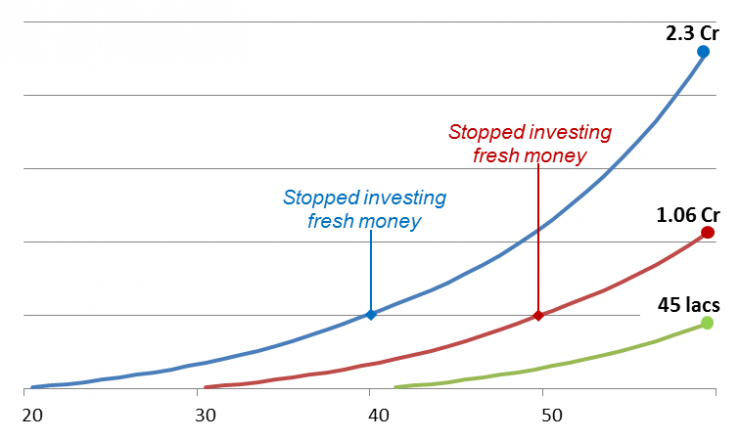

Why Compounding Needs Time

In the early years, returns look modest. But over time, each year’s return adds to a bigger base, accelerating your growth. This “hockey stick” curve is why most people underestimate compounding. It feels slow at first, but after a tipping point (usually around year 10–15), the results become explosive.

The key isn’t how much you invest — it’s how early and how consistently you invest.

Example:

Which Funds Are Suitable?

Here are a few popular categories to start your SIP journey:

| Fund Type | Risk | Return Potential | Ideal For |

|---|---|---|---|

| Large Cap Funds | Moderate | 10–12% | Stable, long-term core |

| Mid Cap Funds | Moderate-High | 12–15% | Wealth creation |

| ELSS (Tax Saving) | Moderate | 10–14% | Tax planning + returns |

| Index Funds (Nifty 50) | Moderate | 10–12% | Passive investing |

Note: Choose Direct Plans for lower cost and higher returns.

Key Takeaways

- A ₹5,000 SIP for 30 years can make you a crorepati — thanks to compounding.

- Time in the market beats timing the market.

- Start small, start early — and stay consistent.

- Choose equity mutual funds for long-term wealth creation.

- The real risk is not starting — not the market.

Final Word

You don’t need to be rich to get started. You need discipline. You need time. And you need to trust the process.

Even if you can’t start with ₹5,000 a month — start with ₹500. Let it grow. You’re not just investing money — you’re investing in your future freedom.

Want help choosing the right SIP fund or platform to start? I can guide you with tailored recommendations based on your goals and risk appetite.